how much does nc tax your paycheck

There is a flat income tax rate of 499 which means no matter who you are or how much you make. Therefore it will deduct only the state income tax from your paycheck.

Hourly Paycheck Calculator Nevada State Bank

The state income tax rate is 525 and the.

. Just enter the wages tax withholdings and other information required. Individual Income Tax Sales and Use Tax Withholding Tax Corporate Income Franchise Tax Motor Carrier Tax IFTAIN Privilege License Tax Motor Fuels Tax. The state of North Carolina requires you to pay taxes if you are a resident or nonresident that receives income from a California source.

Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. It is a flat rate that is unchanged. Depending on your filing status you pay federal income tax at a rate of 22 on your taxable income.

No state-level payroll tax. 9 rows the income tax is a flat rate of 499. For tax years 2015 and 2016 the north carolina individual income tax rate is 575 00575.

Rates can be as low as 006 or as high as 576. To pay this tax each quarter you will complete the Employers Quarterly Tax and Wage Report to report wage and tax information. North Carolina moved to a flat income tax beginning with tax year 2014.

The North Carolina income tax has one tax bracket with a maximum marginal income tax of 525 as of 2022. When it does come to the tax side of things if youre considering a move to North Carolina for retirement its important to keep the following in mind. Social Security income in North.

Overview of North Carolina Taxes North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. North Carolina payroll taxes are as easy as a walk along the outer banks. In North Carolina The state income tax in North Carolina is 525.

North Carolinas flat tax rate for 2018 is 549 percent and standard deductions. That rate applies to taxable income which is. For tax year 2021 all taxpayers pay a flat rate of 525.

There is a flat income tax rate of 525 which means no matter who you are or how much you make this. Each employers payroll for the last three fiscal years as of July 31 of the current year. North Carolina Payroll Taxes There is a flat income tax rate of 525 which means no matter who you are or how much you make this is the rate.

How much is payroll tax in NC. North Carolina payroll taxes are as easy as a walk along the outer banks. Based on economic conditions an employers tax rate could be as low as 0060 or as high as 5760.

Detailed North Carolina state income tax rates and brackets are available on.

Salary Paycheck Calculator Calculate Net Income Adp

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

W 4 Form What It Is How To Fill It Out Nerdwallet

How Many Exemptions Do I Claim On My W 4 Form Tandem Hr

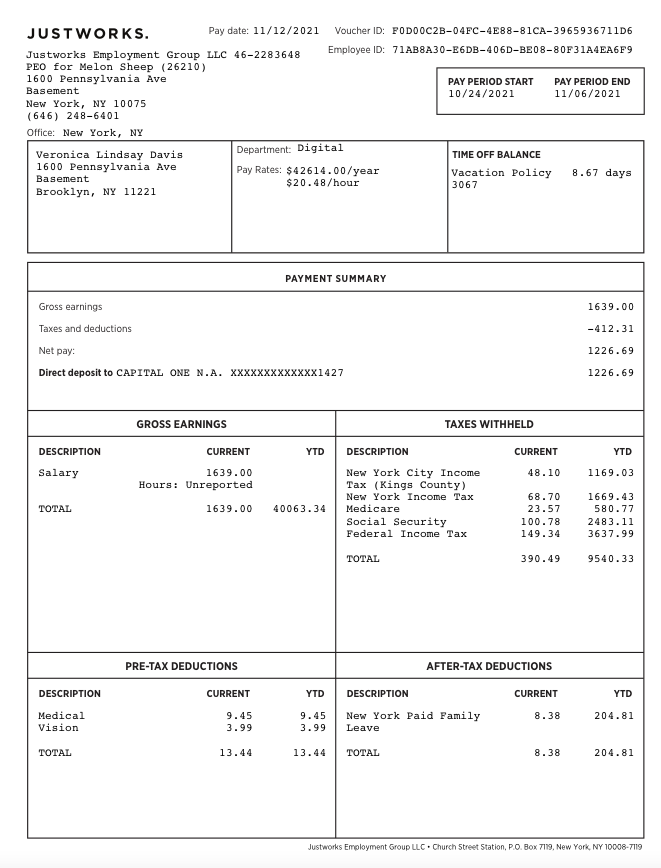

Questions About My Paycheck Justworks Help Center

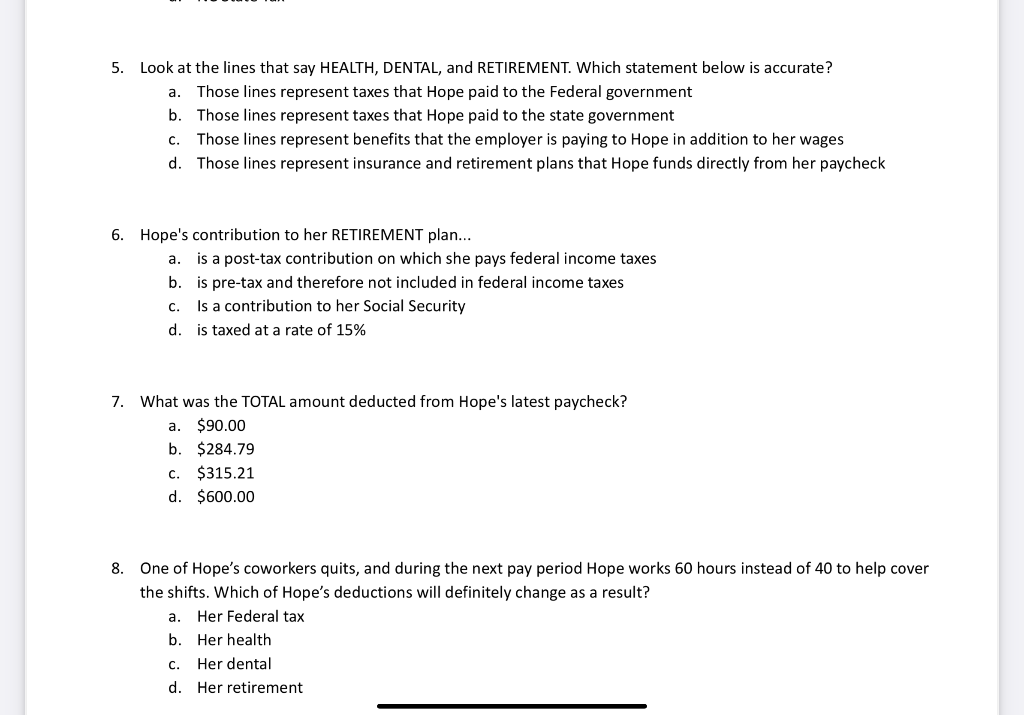

Solved Earnings Statement Company Name Some Corporation 123 Chegg Com

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

How To Complete Your Nc Withholding Allowance Form Nc 4 Youtube

Paycheck Tax Withholding Calculator For W 4 Tax Planning

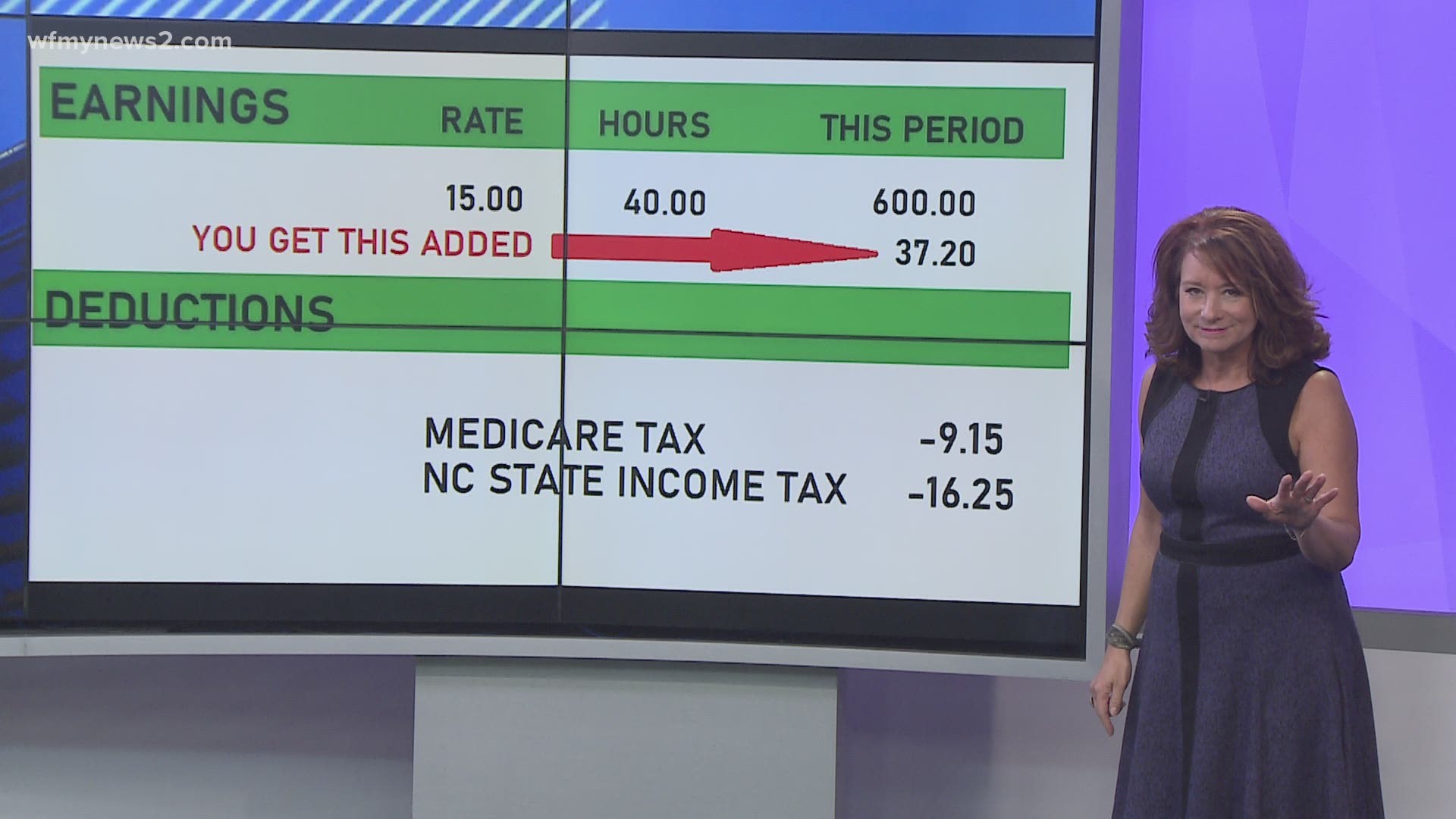

The Payroll Tax Deferral Means Less Taxes Now More Taxes Later Wfmynews2 Com

State Income Tax Rates And Brackets 2021 Tax Foundation

North Carolina Income Tax Calculator Smartasset

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

How Much Will Typical Middle Class Workers Really See Their Paychecks Change Itep

State Conformity To Cares Act American Rescue Plan Tax Foundation